History and Policy Making Conference with Bank of England

A two-day event bringing together senior officials and academics to consider the contribution of historically informed inquiry...

05 January 2021

Professor David Aikman shares his thoughts on the use of economic history in central bank policy-making, after participating as a respondent at the Bank of England's 2-day conference on 'History and Policy-making'

The Qatar Centre of Global Banking and Finance recently organised a virtual conference with the Bank of England on the topic of 'History and Policymaking'. As part of the programme, David Aikman (Director of the Centre) joined Eric Monnet (Paris School of Economics) to discuss Eric’s paper, ‘Theory, Empirics and History – Three Perspectives for Policy-Making’. David shares his thoughts below on the use of economic history in central bank policymaking.

Eric Monnet contends that economic history is essential for central bankers because it provides them with a third way to analyse policy questions, beyond economists’ traditional tools of theory and empirical analysis. History gives context, an understanding of the salience and uniqueness of today’s issues relative to the past. Eric’s piece on Theory, Empirics and History – Three Perspectives for Policy-Making provides interesting insights on how historical thinking can support the issues central banks are grappling with today.

In my remarks, I presented some freshly compiled statistics on the use of economic history at central banks. I looked at working papers published since 2000 by five leading central banks: The Bank of England, the Federal Reserve Board, the ECB, the Banque de France and the Bank of Canada. (This analysis could usefully be expanded to other central banks. For instance, the Banca d’Italia has a well-regarded bespoke working paper series dedicated to economic history research, a link to which is here.)

I classified a paper as applying economic history methods if, based on its title and abstracts, it either: (a) uses a long-run dataset, extending back prior to WWII, or (b) provides a substantial analysis of a historical period (pre-1990) or of an economic theory. Of the 6606 papers published by these institutions, 118 met these criteria.

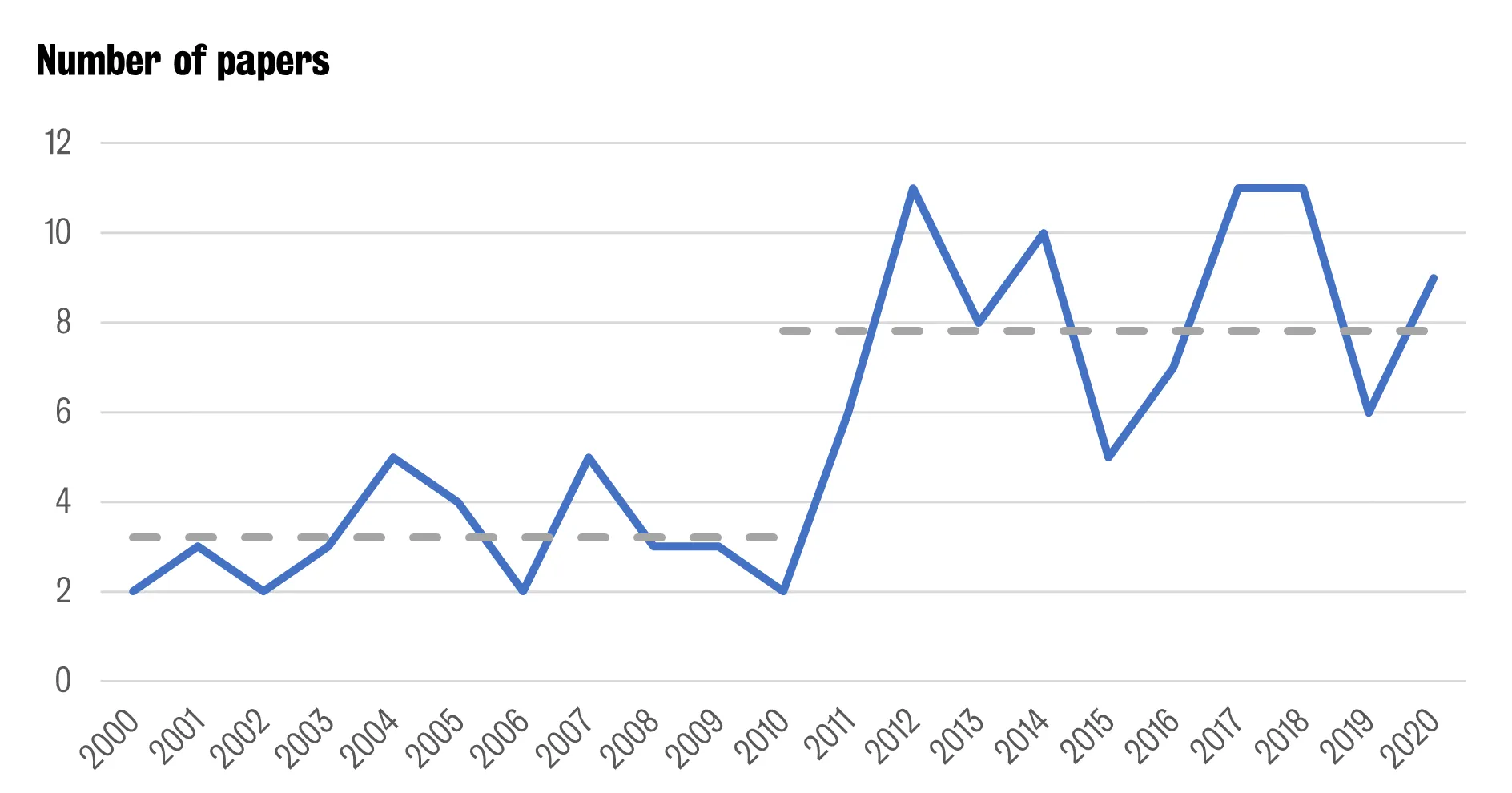

Figure 1 below plots the number of working papers published per annum by these central banks meeting these criteria. The step-change in economic history research since the global financial crisis is striking. Between 2000 and 2009, around three economic history papers were published between these central banks per year. Since 2010, that figure has risen to almost eight papers per year. Expressed as a per cent of total working papers published, central banks’ research output on history has increased from 1.2% of papers published to 2.2% after 2010.

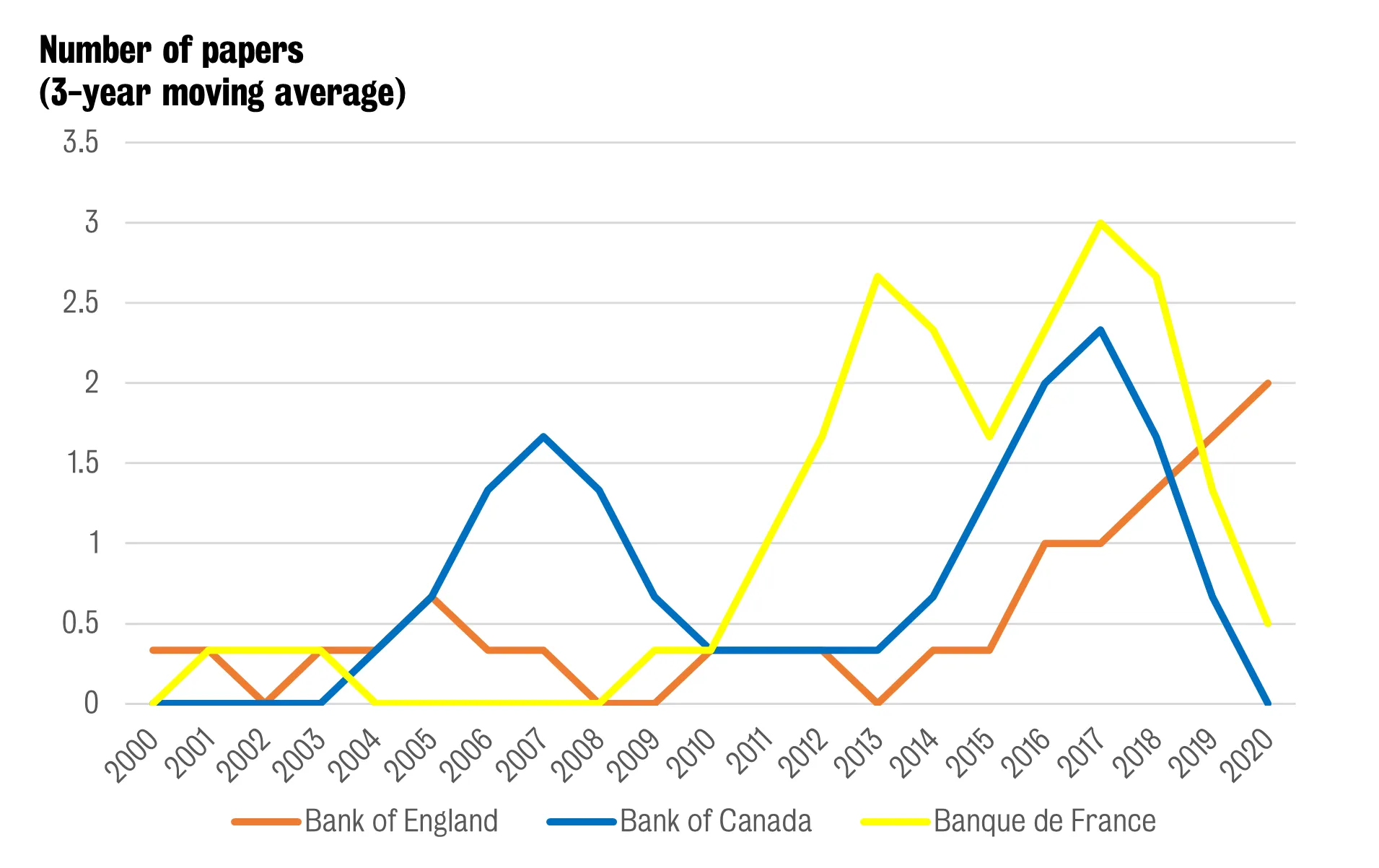

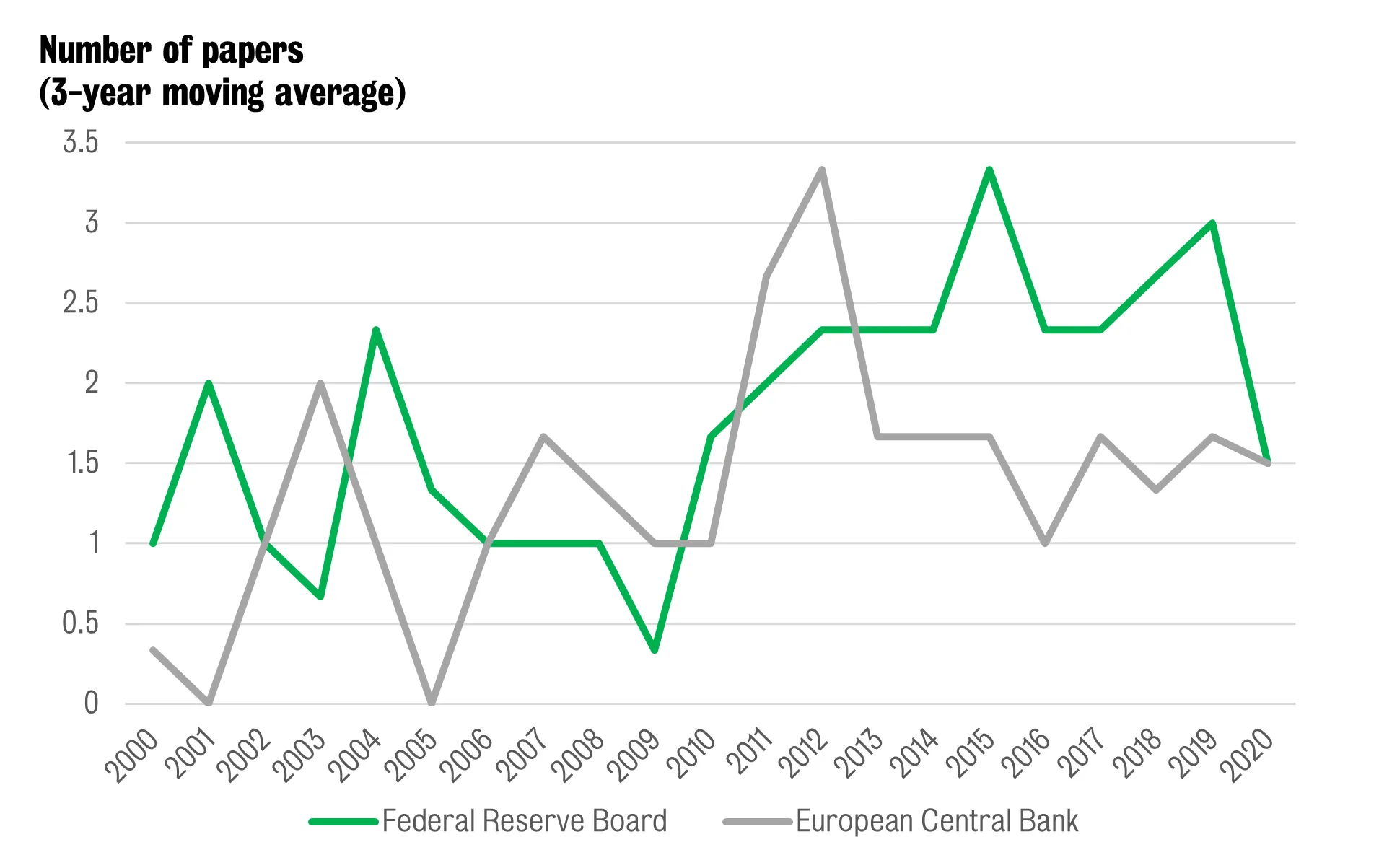

Figures 2 and 3 below break this down by central bank. All have expanded their economic history research over the period. The increase has been especially stark at the Bank of England and Banque de France. Before 2010, these institutions produced very little economic history research: only three such papers were published by the Bank of England in that decade and only one by the Banque de France. Since 2010, their output has increased substantially. In contrast, economic history has been an established line of research at the Fed Board, with a consistent flow of papers throughout the two decades.

This trend is not simply a reflection of what’s happening in the wider economics profession: according to EconLit, the proportion of economic history papers published in refereed journals has remained pretty flat at 0.2% over the past two decades.

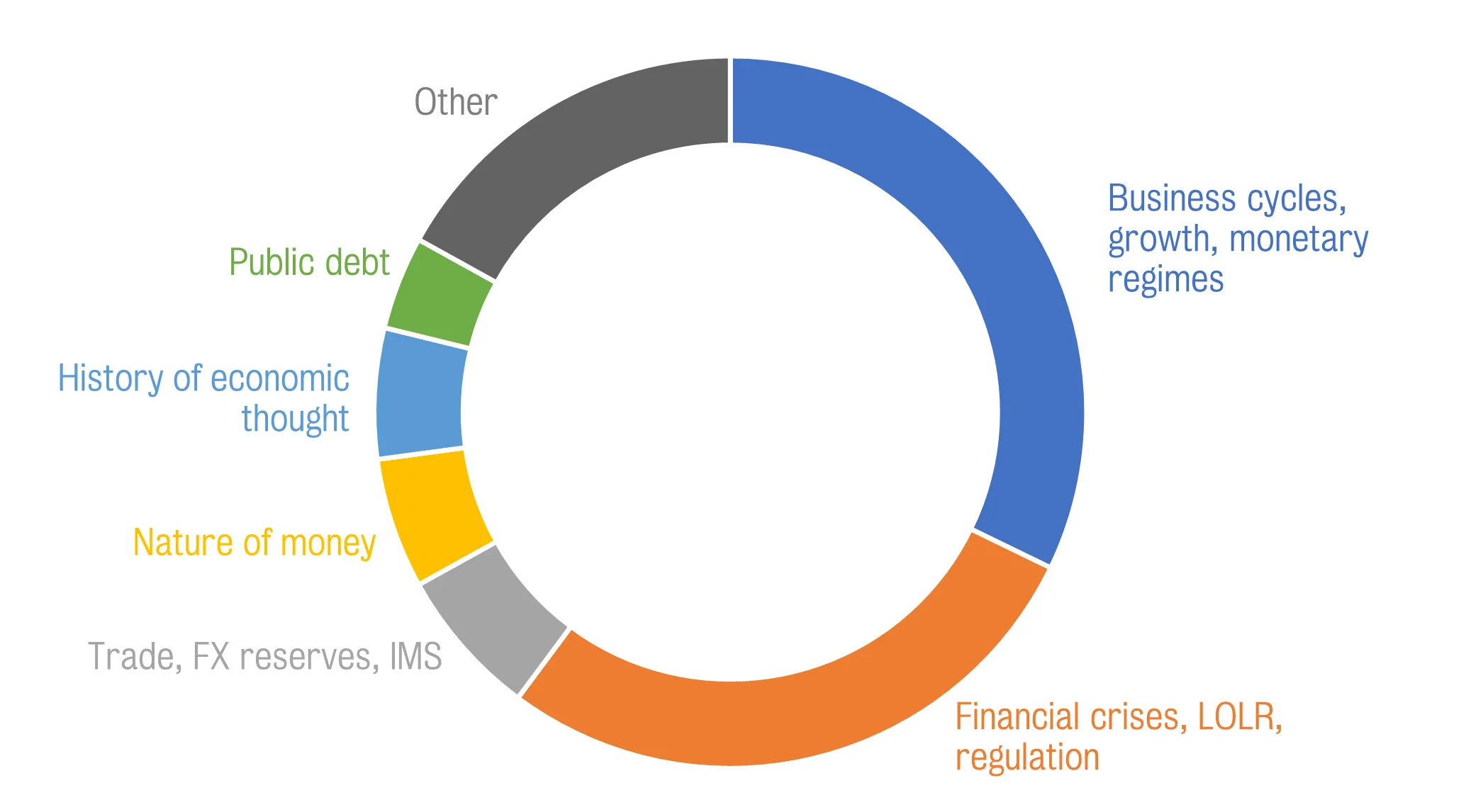

Figure 4 below answers this question. Each segment shows the proportion of economic history papers published on the topic listed. The most researched topics are macroeconomics-focused (business cycles, economic growth, and monetary regimes) and financial stability-focused (on crises, regulation, and central banks’ liquidity frameworks). Whilst this is perhaps unsurprising, it’s interesting that two of the hottest topics facing central banks right now -- the impact elevated public levels will have on monetary and financial stability and the advent of digital currencies and the nature of money -- have attracted relatively little research. I expect this to change in the years ahead.

I concluded my talk with some thoughts on how central banks can cement the gains made in this area in the past decade. With new historical datasets created and information from central banks’ archives made publicly available, this is likely to foster a self-fulfilling process of continued research in this area. It’s important though that those making hiring and appraisal decisions at central banks emphasise the value in this line of research. That means referencing economic history papers in speeches and policy documents. It also means retaining researchers with expertise in this area, who can help guard the institutional memory of these institutions. In this respect, it’s unfortunate that the Bank of England’s recently revamped research strategy makes no mention of the essential role of historical analysis.

A two-day event bringing together senior officials and academics to consider the contribution of historically informed inquiry...