30 April 2020

Role of macroprudential policy in the Covid crisis

Professor David Aikman, Director of the Qatar Centre for Global Banking & Finance

If a relaxation in regulatory capital requirements is ever likely to be effective, it is now.

2008 was a crisis of finance. The Covid crisis is different – governments around the world have deliberately put their economies in medically-induced comas to flatten the curve of the pandemic. The consequence collapse in economic activity will, however, spill over to financial systems all the same, as losses from borrower defaults and asset price falls threaten financial stability.

In contrast to 2008, central banks and financial regulators have spent much of the past decade building resilience into their financial systems in the name of macroprudential policy. Banks now have substantial capital and liquidity buffers, and mortgage borrowing by households has been curbed in many countries. The aim of these policies is to prevent shocks being amplified by the financial system as happened so dramatically in 2008.

In this article, we ask how effective these measures are likely to be in the current crisis. We examine the steps taken since the Covid outbreak began and describe their intended effects. We also assess whether countries have responded in similar ways with the aim of sharing best practices. To preview our conclusion, while macroprudential policies are playing perhaps a tertiary role in the crisis – behind health policies and fiscal/liquidity injections. Nevertheless, the responses we’ve seen have been impressive in their speed and innovation and should help the financial system act as a shock-absorber this time round.

The aim of macroprudential policy in this crisis

Since the Covid crisis began, macroprudential regulators have sought to enable banks to use their built-up resilience to support the economy now. In particular, most actions have relaxed banks’ capital requirements. Why is this?

Bank balance sheets are being hit in several ways by the Covid crisis. Some of the loans that banks extended in the past will go sour as unemployment and company insolvencies increase. Moreover, new “expected loss” provisioning rules being phased-in globally will bring forward some of these hits to capital to the present. The higher risk of loss will also mean an increase in measured risk weighted assets, mechanically reducing banks’ capital ratios. And banks will be under intense pressure from governments to provide liquidity to customers during the lock-down, with the expansion in their balance sheets also reducing their capital ratios.

All else equal, this erosion in capital – or indeed just its prospect – would create strong incentives for banks to shrink their assets, either by stopping lending to households and companies (causing a “credit crunch”) or by fire-selling securities. Either route would have severe contractionary consequences for the economy.

To see why, consider a banking system with a balance sheet of £1 trillion and a leverage ratio of five per cent – even after all the Basel III reforms, this leverage ratio is roughly that of advanced economy banking systems entering this crisis. If this system suffers a £10bn loss, it will need to contract its balance sheet by £200bn to maintain its pre-shock capital ratio. Leverage is a huge amplifier of shocks!

This adverse process can be short-circuited if instead banks allow their capital ratios to fall following the shock. In our simple example, if the banking system absorbs the £10bn hit to its capital by allowing its leverage ratio to fall to four per cent, it no longer needs to shrink assets and the shock is no longer amplified. Equivalently, we might say that the lending capacity of the banking system in this case is £200bn higher than when its leverage ratio must remain at five per cent. This extra lending capacity is precisely what macroprudential regulators are trying to achieve by relaxing capital requirements now.

If a relaxation in regulatory capital requirements is ever likely to be effective, it is now. The demand from households and companies for bank credit to meet liquidity needs is very high. And while bank equity prices have fallen significantly, we do not appear to be in a situation where solvency concerns mean that the market-imposed constraint is binding.

What specific macroprudential actions have been taken?

Countercyclical capital buffers (CCyB)

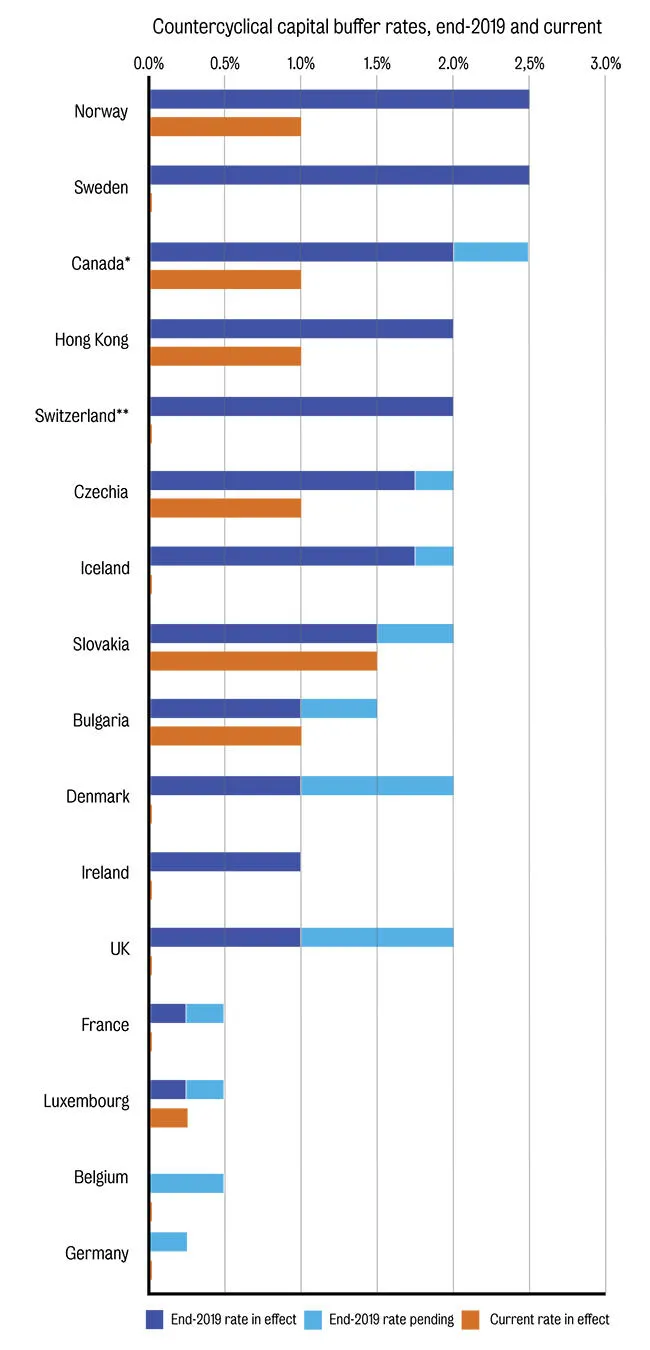

Cutting the CCyB is the most direct and transparent way of achieving a relaxation in required capital. The chart below plots CCyB rates for the 15 countries that have activated this tool to date (I’ve included Canada and Switzerland, which had similar tools in place). The blue bars show the rates in effect at the end of 2019, with the lighter shade indicating decisions that had not yet taken binding effect. The orange bars are the rates in effect at the time of writing (9 April).

It’s encouraging that this tool is being used exactly as intended. Most countries have already released this buffer, either in full or substantially (the exceptions are Luxembourg, Bulgaria, Slovakia). This puts paid to the often-heard critique that these buffers would never be reduced. In most cases, releases have been accompanied by commitments that the buffer will not be hiked any time soon (eg the UK’s FPC has committed to the buffer remaining at zero per cent for at least 12 months). This “time-based forward guidance” removes once source of uncertainty in banks’ capital planning decisions, which should make it easier for them to support the economy.

While the buffers built up prior to this crisis are on the small side (I’ve previously argued that buffers around five per cent would be desirable) , the impact of their removal on lending capacity can be large – this is just the flip-side of how leveraged banks currently are. The release of the one per cent CCyB rate in the UK reduces the aggregate capital requirement by less than half a per cent. But it means the UK banking system can absorb around £11 billion of losses while maintaining its current lending path, or equivalently, it can preserve its lending capacity by £200-250bn.

Other capital buffers

By contrast, other capital buffers do not have an explicit release mechanism, and as such, it’s likely to prove more difficult to encourage their use. For example, the 2.5 per cent capital conservation buffer and domestic and global systemic importance buffers cannot be cut. Banks can enter these buffers but will face restrictions on their dividends and bonuses if they do. They may prefer to shrink assets to avoid these restrictions.

For this reason, regulators have had to innovate on the fly. One approach has been to ease temporarily how some rules are enforced. The clearest example is by APRA, the Australian prudential regulator. On 19 March, APRA announced that, provided banks meet minimum requirements, it will be relaxed about banks’ capital positions during the Covid-19 disruption. Similarly, on 12 March, the ECB announced it was releasing its “Pillar 2G” stress test buffer in full until further notice – removing around €90 billion in required CET1. And the Canadian prudential regulator OSFI announced a temporary reduction in the “stressed VaR” multiplier it applies when calculating capital requirements on banks’ trading books.

Another innovation has been to make running repairs to existing rules to ensure they work with the grain of other policy measures. An example here is the exemption of central bank reserves and government securities from the leverage ratio. This idea, which originated at the Bank of England after the Brexit referendum, aims to ensure the leverage ratio isn’t a barrier to quantitative easing measures. On 1 April, the Fed announced reserves and Treasuries will be exempted from the supplementary leverage ratio until March 2021. Whereas the BoE’s response was capital neutral in its implementation, the Fed’s approach will relax Tier 1 capital requirements by around $17 billion.

In similar vein, many regulators have adjusted their capital rules to assign zero risk weights to new loans to small businesses created through government support programmes (e.g. this by the Fed, and this by OSFI). OSFI also announced that loans subject to payment deferrals will not be treated as delinquent for the purpose of calculating risk weights.

We’ve also seen regulators scramble to fast-forward the introduction of some previously planned measures where the impact will loosen requirements. For instance, the ECB is bringing forward rules that will allow banks to meet a larger proportion of their minimum capital requirement with coco bonds and subordinated debt instruments (under “CRDV”). This will reduce required CET1 capital by €30 billion euros. Similarly, the Fed announced that it will be allowing banks to adopt early a more lenient approach to measuring the exposure in derivative contracts.

Finally, the Basel Committee has amended its guidance for the capital treatment of new expected loss provisioning rules to reduce their impact on CET1 capital for the next two years.

Dividend restrictions

While most countries have relaxed capital requirements in one form or another, far more controversial has been the decision to require banks to suspend dividends, share buy-backs and bonus payments.

The Swedish regulator Finansinspektionen was the first to do this, despite Swedish banks having capital ratios that are high by international standards. The ECB and the Bank of England then followed suit. APRA has requested Australian banks and insurers limit discretionary distributions. And OFSI has suspended share buy-backs for Canadian banks. US regulators, by contrast, have not intervened in this way.

Blanket, across-the-board suspensions were explicitly not part of the ex ante plan for dealing with a crisis. Basel 3 raised capital requirements by a factor of ten to ensure banks would have enough capital entering the next crisis. An individual bank would face dividend restrictions only if losses meant its capital fell below particular thresholds. The pay-out restrictions we’ve seen in this crisis are far more nuclear – they shut down dividends for all banks, regardless of their capital position.

Why have regulators done this? First, given the scale of the unfolding crisis, some regulators may simply be worried that existing buffers won’t suffice. While regulators deny this, they remain scarred by the experience of the last crisis where banks continued to return significant amounts of capital to shareholders even as the crisis was unfolding. Recall that each £1 of retained capital can be levered to create around £20 in new loans, so forcing banks to retain capital is simply prudent at this stage. After all, UK banks were expecting to return £25 billion in capital to their shareholders over 2019-20 and pay bonuses of over £11 billion.

Second, there has been a transatlantic divide in the way stress testing programmes have operated with respect to dividends. As a recent paper by Don Kohn and Nellie Liang emphasises, the Fed’s CCAR stress tests prevent banks from bolstering their capital positions by assuming lower pay-outs during the stress scenario – in effect, this has forced US banks to pre-fund their dividend plans with adequate capital. In contrast, the BoE’s stress test results are less conservative and allow banks to assume an almost complete suspension of distributions during the stress (see box 5 of their latest results document). The differing responses of macroprudential authorities in the crisis is therefore consistent with what was baked into pre-shock stress testing approaches.

Third, there is a theoretical argument that imposing a blanket ban on distributions will help make other buffers more usable. The argument here is that it removes the stigma of banks entering their capital conservation and systemic risk buffers. As none of their competitors will be paying dividends either, there is no adverse signal per se in a bank allowing its capital ratio to fall into the region subject to mandatory distribution restrictions. (This paper by Viral Acharya and co-authors presents a model in which dividend pay-outs create negative externalities for other banks).

Concluding thoughts

The table below summarises how macroprudential authorities in different countries have responded so far to the Covid crisis.

Overall, banks have been granted a material reduction in their capital requirements via releases in the CCyB and a variety of other ad hoc measures. Many regulators have also rightly suspended dividends. In principle, these actions should provide them significant lending capacity to support the real economy during the crisis. Of course, the reckoning on the effectiveness of these various measures – and in particular whether banks should have had higher usable capital buffers entering the crisis – will come.