14 March 2022

Supporting the Turkish Lira: Assessing the controversial experiment of the Turkish central bank

Coskun Tarkocin (HSBC and Visiting Research Fellow of the Qatar Centre for Global Banking and Finance)

QCGBF Visting Research Fellow, Coskun Tarkocin writes on Turkey’s controversial experiment to support the Lira.

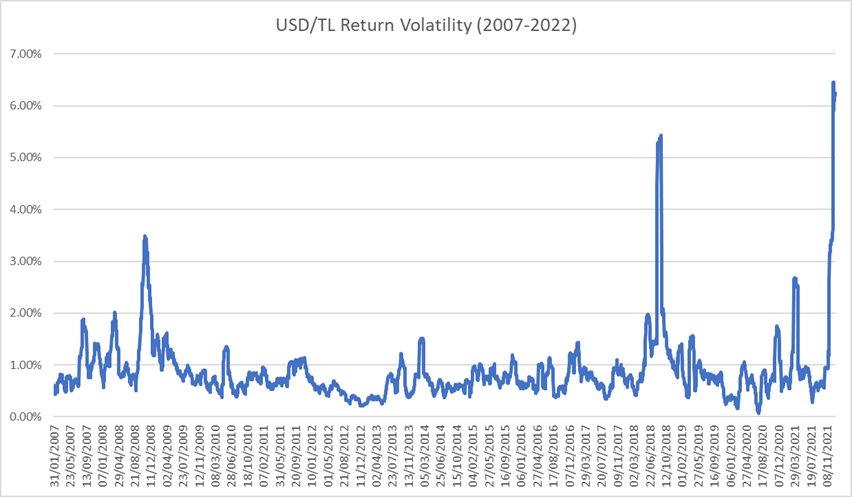

In December 2021, the Turkish Lira experienced its highest daily volatility in its recent history, higher even than during the global financial crisis of 2007-2008 (Figure 1). In response, the Turkish Government announced a series of extraordinary policy measures aimed at protecting the value of the Lira. One of the most radical is a government guarantee against losses due to currency depreciation to encourage individuals to convert their FX deposits to Lira time deposits.

This policy tool allows account holders to earn interest on Turkish Lira savings while the capital value in the originated hard currency/gold is guaranteed. For example, if an investor converts a 100TL-equivalent FX deposit to a TL deposit with a maturity of at least three months, she will earn the deposit rate for that term. At maturity, if the Turkish Lira has depreciated by more than the interest rate earnings made, the government will pay the difference for the loss.

This blog will focus on two aspects of this new policy tool: the term structure of the deposits and the difficulty of changing them while providing sensitivity analysis to show the relationship between success rate and risk-taking. Although this policy tool has a macroeconomic scope, it requires micro behavioural change on behalf of deposit holders to achieve its intended outcome. To have a meaningful impact, a large fraction of existing FX deposits will need to convert into Turkish Lira deposits covered by the new scheme. But the larger this take-up, the greater are the contingent insurance costs to the Treasury in the event of a Lira depreciation.

How the new policy tool will work

The requirements to benefit from the government guarantee are as follows:

- Retail deposits (real persons) and corporate deposits can benefit

- The minimum tenor should be 3 months, other applicable tenors are 6, 9 and 12 months, original FX account can be any tenor

- The minimum interest rate is the CBRT’s weekly repo rate. The interest rate on TL time deposits can go from the policy rate to a maximum of 300bps above it paid by the banks.

- Reference FX rates at the beginning and end of the term deposits will be announced by the CBRT daily.

- In case of early termination of the TL time deposit account, government will not compensate any loss.

- New accounts can be opened from 21 December 2021, which means the FX savings accounts should exist before this date, for corporate deposits cut off date is 31 December 2021.

- At maturity, if the sum of principal and interest is below the value that would have been realised if the principal had been held in an FX account, the difference will be paid by the Treasury.

- Currently, there is no closing date, any time it is possible to join and no cap proposed by the Treasury.

Term Structure of FX Deposits

Based on data from the Turkish Banking Regulation and Supervision Authority, deposits in the country’s banking sector as of 31 December 2021 amount to $401.6bn, of which $245.8bn belong to real persons and two-thirds ($164.4bn) are denominated in foreign currency.[1]

The Turkish Banking Association estimate that 91% of these FX deposits have a maturity of less than three months (Table 1). While 59% points of this amount is in 1- to 3-month bucket, in practice these deposits are likely to be heavily clustered at the short end of this window.[2] Evidently, deposit holders are not keen to lock in their money for longer maturities.

As the new policy tool requires at least 3-month deposits, one hurdle will be to overcome this liquidity preference to ensure a sufficient take-up of the scheme.

Table 1: Term Structure of FX Deposits (30 September 2021[3])

|

Demand |

Up to 1 month |

1–3 months |

3–6 months |

6–12 months |

1 year + |

|

19% |

13% |

59% |

5% |

1% |

2% |

Analysis of the potential cost of the scheme

To analyse how much this scheme might cost the Turkish Treasury, we assume the following: the tenor for all FX-hedged TL time deposits is 1 year, a conservative assumption given the data in Table 1; the starting amount is $253.5bn (as of 31 December 2021); the deposit conversions originate from US dollars; the TL interest rate is 14% and does not change during the period in question.

While we assumed a 1-year tenor for the sensitivity analysis, looking at the deposits’ term structure, the higher portion of investors will likely be at the short end of the curve, which means once TL deposit matured depositor will need to decide if they want to continue be part of the scheme (i.e. there is rollover risk). In other words, someone who is interested in the scheme at the beginning may change their mind and decide to buy back dollars depending on sudden economic shocks and the general risk perception.

Possible scenarios

From an individual depositor’s perspective, this scheme offers a free option (to the extent the guarantee can be honoured). From a policymaker’s perspective, the policy carries significant risk.

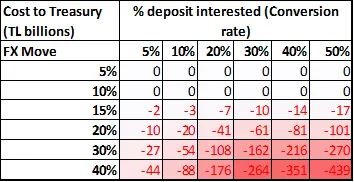

Table 2 illustrates the cost to the Exchequer of the scheme as a function of the size of the insured deposit base and the size of the depreciation of the Turkish Lira. By design, the scheme has no fiscal cost if the depreciation of the Turkish Lira is lower than the weekly repo rate set by the CBRT (assumed to be 14%). But in the event the Lira depreciates more than this, the costs could be significant: for instance, a 30% depreciation could lead to costs of between TL35bn-TL105bn depending on the size of deposits transferred to the scheme.

If the fiscal costs are sufficiently large, this policy could end up aggravating the problem it is designed to solve. In particular, to fund large losses, the Central Bank of Turkey could be pressured to print money to fund large losses, increasing inflation and fuelling further currency depreciation.

A few things to keep an eye on

- A very high percentage of deposit holders might be interested in the incentivised product. A cap may need to be introduced to limit the scale of contingent liability for the Treasury.

- Inflationary pressures, both locally and globally, provide an unhelpful backdrop to the scheme. If inflation increases further, this will put more pressure on the Lira, increasing the potential costs to the Treasury. Similarly, the FED’s rate hike policy and its implications for the US dollar will create additional pressures for emerging market currencies, aggravating the problems faced by the scheme.

- If the policy rate paid to TL deposit holders falls, the potential loss for the Treasury increases.

- The confidence of the deposit holder is a crucial component if the scheme is to be successful. Therefore, regular transparent communication with the targeted investors is required to recognise the risks involved.

- Strategies to attract new investment to the country should continue not only to support the currency but also to make policy tools more attractive by building more trust among investors.

Disclaimer: The views and opinions expressed in this blog article are those of the author, and they do not represent the views of the HSBC Bank Plc and do not constitute advice.

Endnotes:

[1] http://www.bddk.org.tr/BultenHaftalik/en

[2] One of the reasons deposit maturity is clustered around one month is that beyond one month tenors, the term premium paid by the banks becomes zero or immaterial in the local market.

[3] Turkish Banking Association (www.tbb.org.tr).