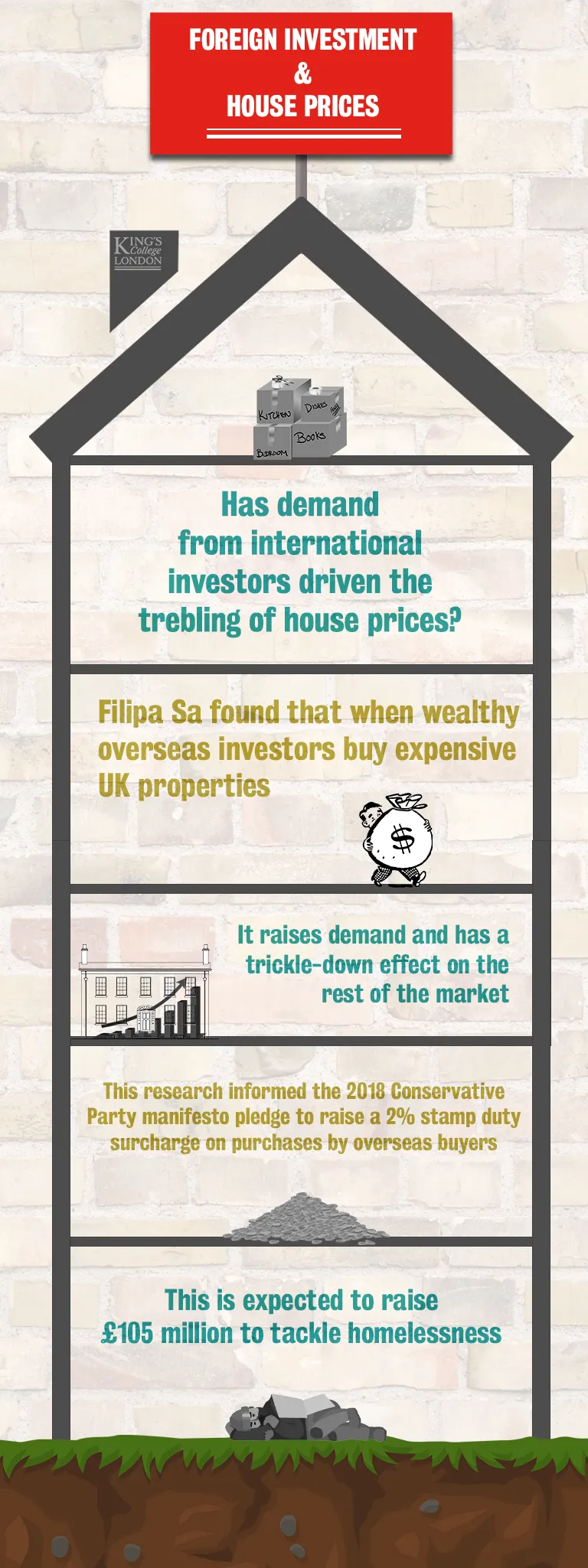

House prices in parts of the UK are among some of the most expensive in the world. With demand for properties across the country showing no signs of abating, and younger people in particular priced out of home ownership in the most popular locations, it is important to understand the cause of these high property prices.

Research conducted at King’s Business School identified that investment by overseas buyers is an important driver of property prices. This evidence has supported a major policy change in the UK.

The average house price in England and Wales has trebled in the last two decades, from just over £70,000 in 1999 to around £230,000 in 2020.

Research carried out by Dr Filipa Sá, Senior Lecturer in Economics, shows that if foreign investment in the housing market in England and Wales had remained at the level it was in 2000, the price of the average home in 2014 would have been between 16 per cent and 28 per cent lower than it actually was. The effect of foreign investment on house prices is not just evident at the top end of the market, it has a ripple effect on the prices of less expensive homes.

Dr Sá’s research also uncovers an interaction between investment by overseas buyers and housing supply, finding that foreign investment has a larger impact on house prices in local areas where housing supply is particularly constrained, either because there is less land available for construction, or because of planning constraints.

Informing government policy

To address this issue, in September 2018 the then Prime Minster Theresa May announced plans for an additional 2 per cent stamp duty tax on overseas buyers’ purchases of residential property. The surcharge will be effective from April 2021. It is estimated that it will generate revenues of £105 million, which will be used to tackle rough sleeping.

Dr Sá adds, "This problem isn’t unique to the UK – other countries, such as Australia, Switzerland and Canada have also been debating this issue and have introduced policies to control foreign investment in the housing market. This is certainly an issue that we need to continue focussing on so that current and future generations can afford to create their own homes across the UK."