Read the report

A major survey over 2,200 people aged 18 to 75 by the Policy Institute at King’s, in partnership with Ipsos MORI and the UK in a Changing Europe, reveals that the British public significantly misperceive key facts around Brexit.

Part of the study takes conclusions from the government-commissioned Migration Advisory Committee (MAC) report, EEA Migration in the UK, and tests these against public perceptions, alongside other facts, such as where UK direct investment comes from, the UK’s payments to the EU and immigrant numbers.

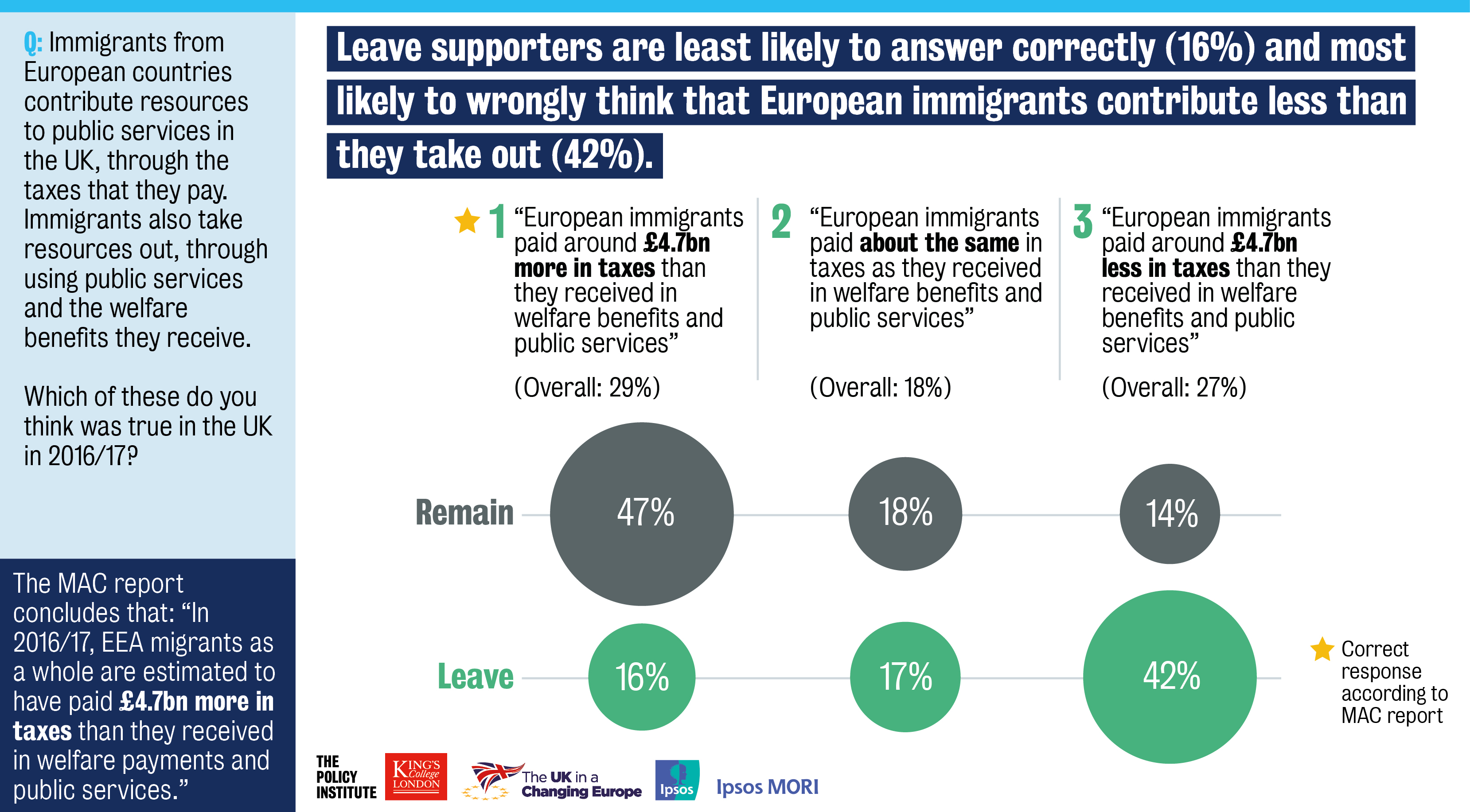

- Only 29% of the public correctly think that immigrants from European countries pay £4.7bn more in taxes than they receive in welfare benefits and services.

- Leave supporters are least likely to answer correctly (16%) and most likely to wrongly think that European immigrants contribute less than they take out (42%).

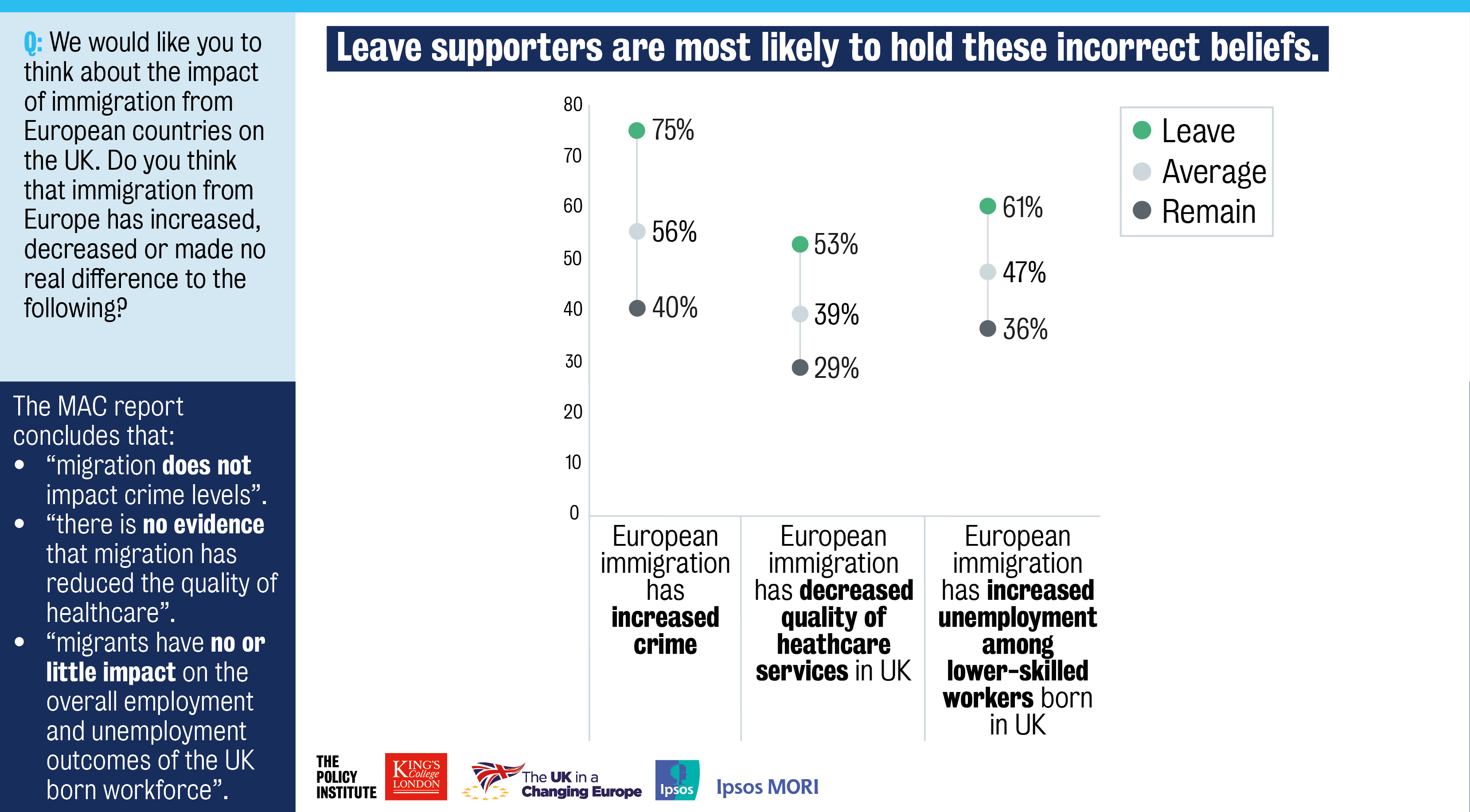

- The three things we get most wrong about European immigration are that it: increases crime, decreases quality of healthcare services, increases unemployment among lower-skilled workers born in the UK. Leave supporters are most likely to hold these incorrect beliefs.

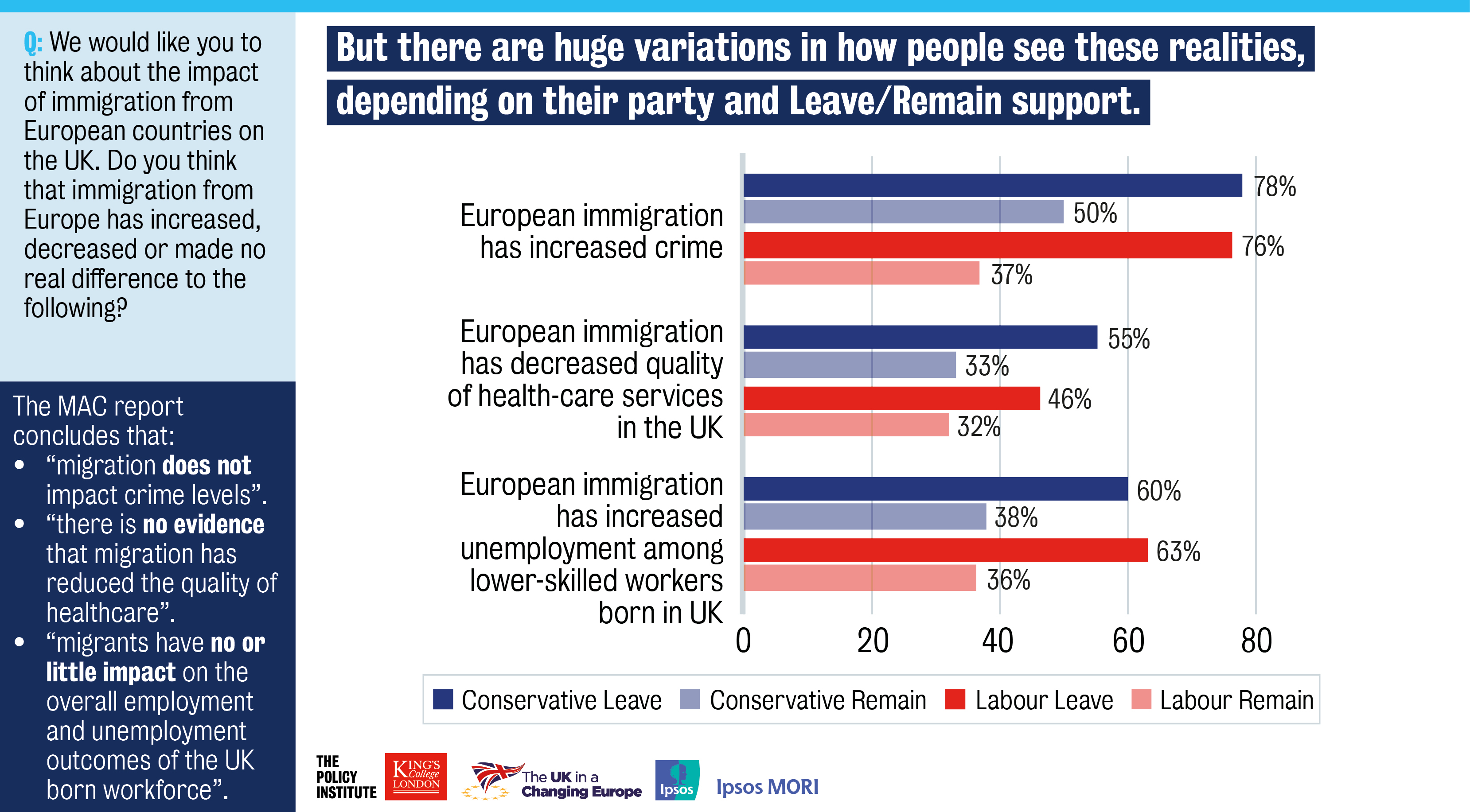

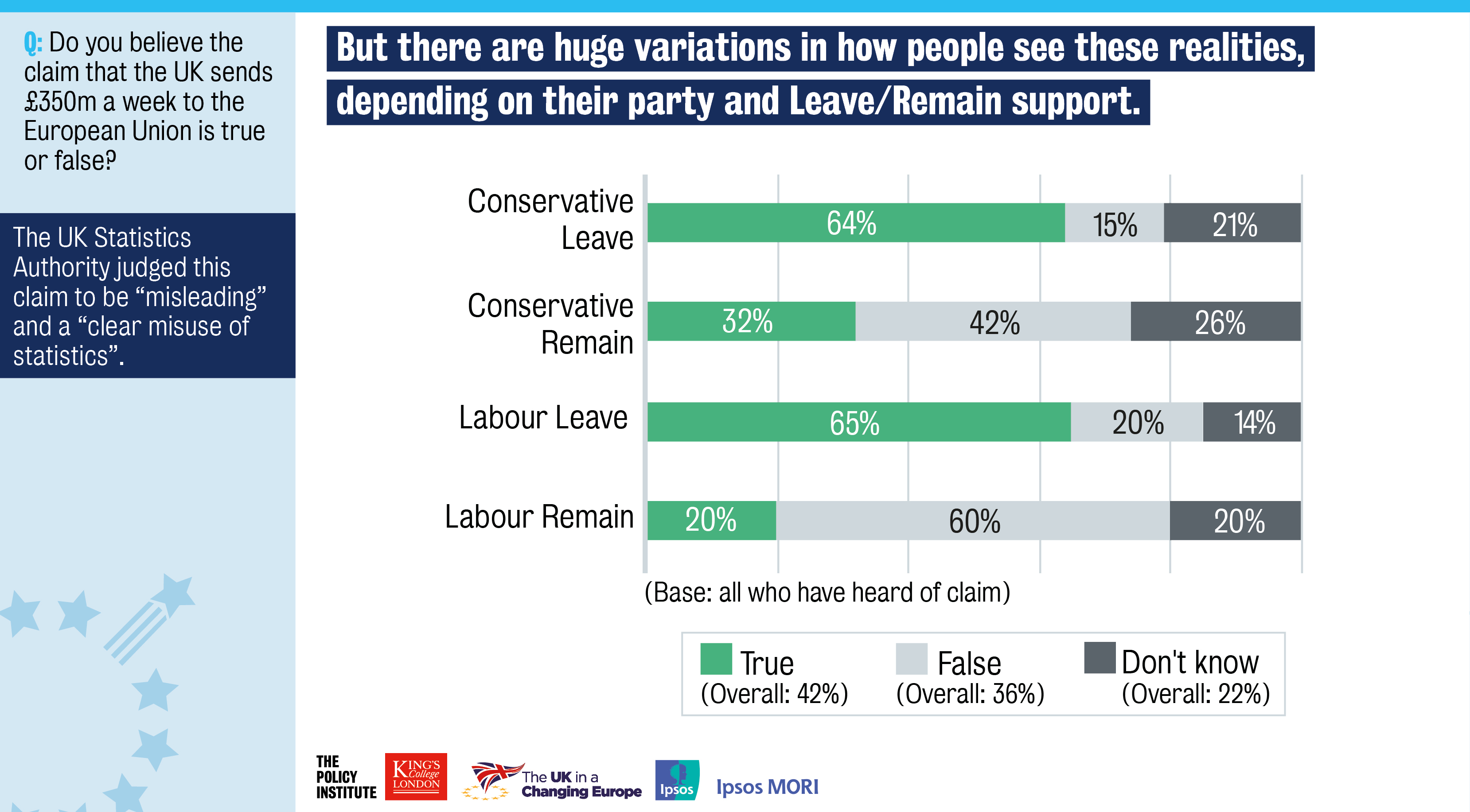

- There are huge variations in how people see these realities, depending on their party and Leave/Remain support.

- Different groups also have very different levels of belief in the claim that the UK sends £350m a week to the EU. Conservative and Labour Leave supporters most likely to believe it (64% and 65%), and Labour Remain supporters least likely (20%).

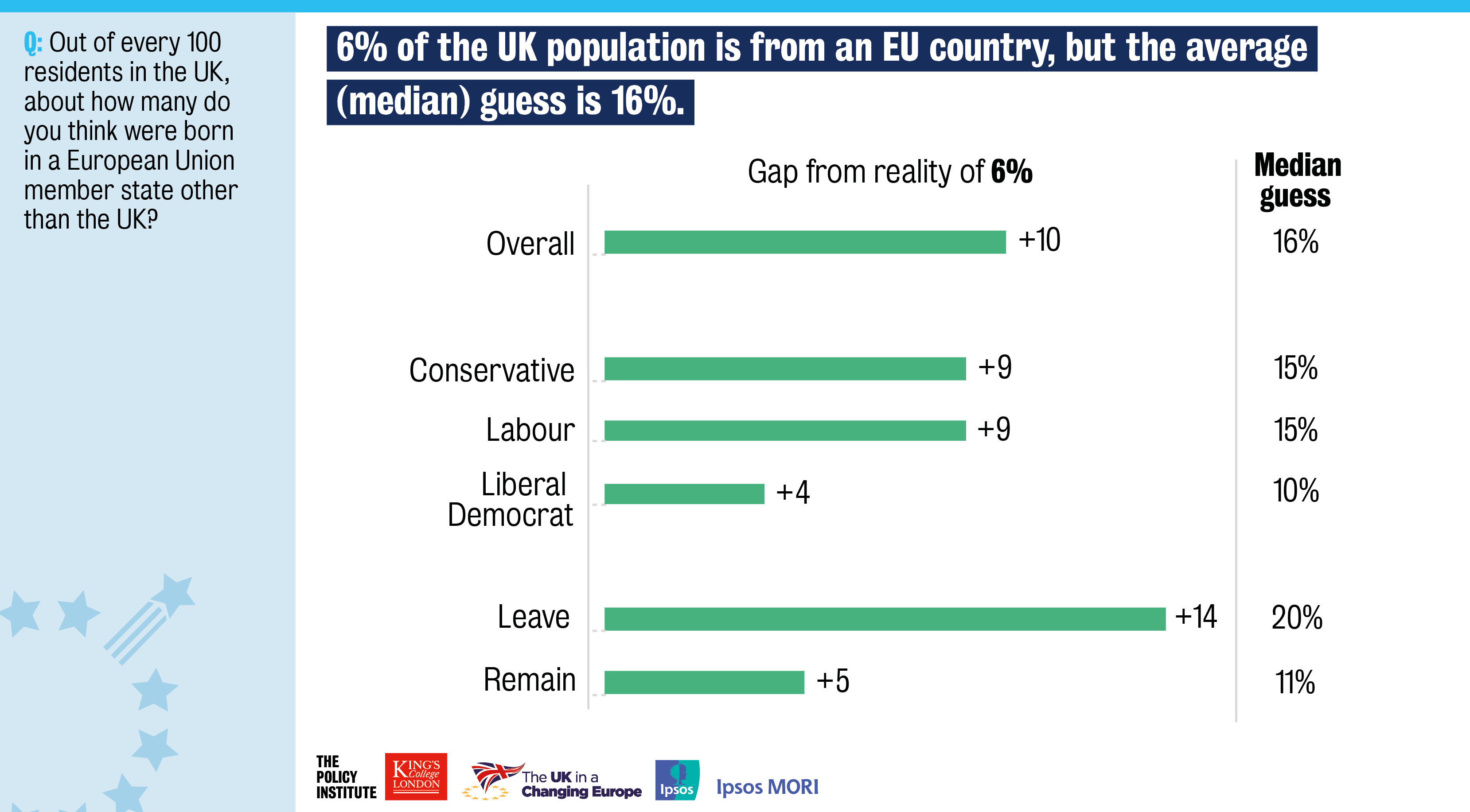

- 6% of the UK population is from an EU country, but the average (median) guess is 16%.

- But there are three facts we’re much more accurate on:

Amendment: 2 November 2018

The original release of the study included the following finding:

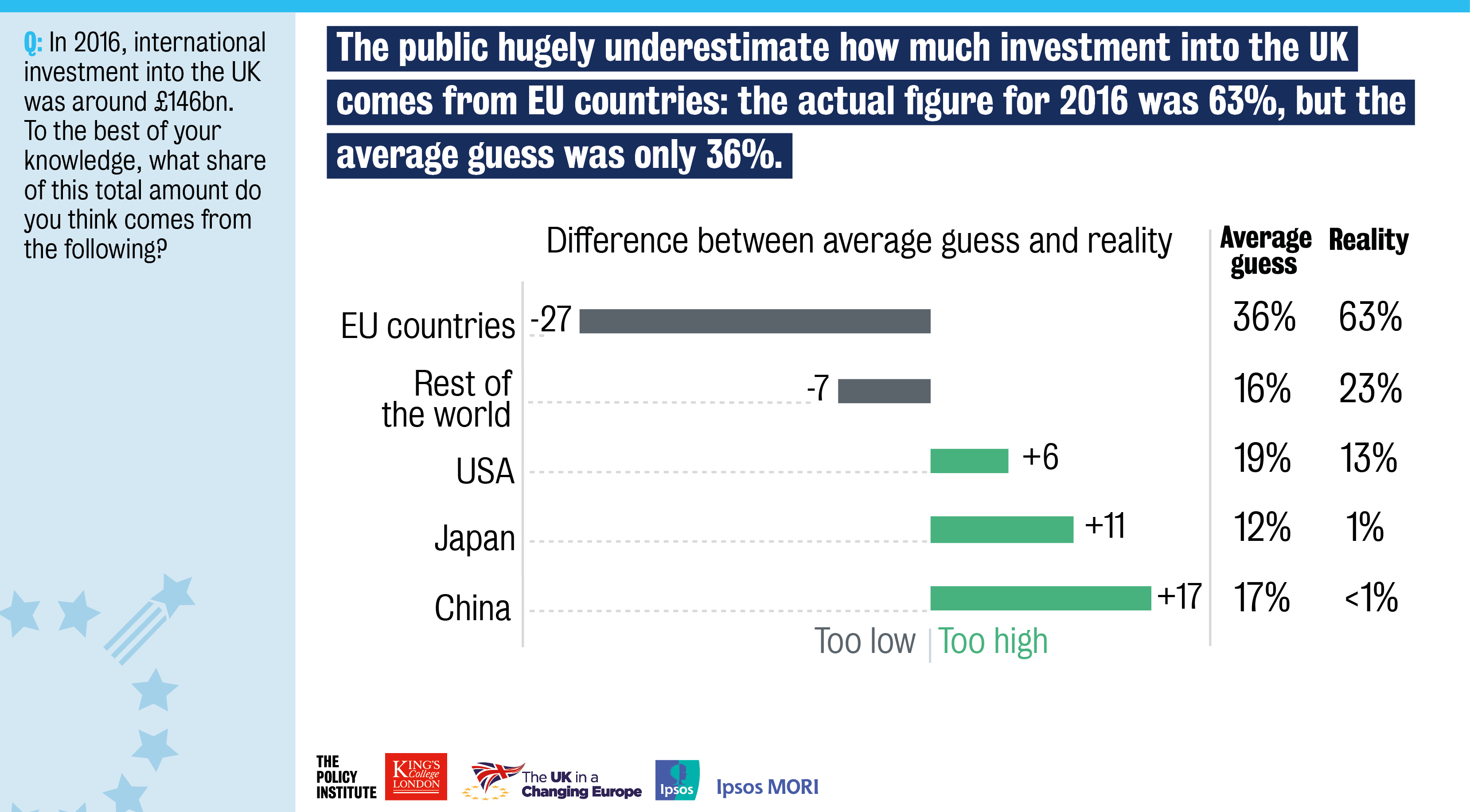

- Investment from EU countries: The public hugely underestimate how much of our investment comes from EU countries: the average guess is 36%, when the actual figure was 63% in 2016

While this reality figure is correct, following helpful feedback, we agree it is important to include a clear qualification and encourage caution in its use, because the 2016 figure is a very significant outlier.

The figure is the net foreign direct investment into the UK in 2016, from ONS data (‘Foreign direct investment involving UK companies’ dataset released by the ONS on December 1, 2017).

It is our practice in all misperception studies to draw on the most up to date available data, as we are interested in perceptions of as current as possible realities. However, net foreign direct investment figures vary significantly year-on-year, and 2016 was particularly unusual.

The ONS notes that “Net flows of FDI into the UK (inward flows) increased from £25.3 billion in 2015 to £145.6 billion in 2016, the largest value recorded since the comparable time series began in 2006. The large value of inward FDI flows recorded were dominated by a handful of high-value M&A deals in 2016; large publicly reported transactions in 2016 included the acquisitions of SAB Miller, ARM Holdings and BG Group.”

The differences are significant: actual annual and cumulative investment over recent years are lower than the public’s estimate (for example, cumulative investment from EU countries in the period 2007-2016 were 27% of the total investment into the UK).

It should be noted in this context that in a 2016 study we asked people to estimate the country/region sources of the total stock of c£1,034 billion international investment into the UK, and the average guess for EU countries was 30%, compared with a reality (based on the most up to date data at the time, from 2014) of 48%. So people underestimated that figure too.

However, while again factually correct, more recent level of investment from EU countries, which are likely to be in people’s minds when answering the question, are significantly lower.

We therefore conclude that the most useful and transparent approach is to still report these findings, but with clear qualifications and to suggest caution in their interpretation.